Services - Risk Management

Asset Protection Risk Management

Every day, each decision we make changes our risk. As the risk alters both positively and negatively, so do our perception of the decisions we have made.

As we enter each new venture banking on success, the more experienced of us also plan for failure. The most effective asset protection structures we can adopt, with the optimal tax position are those commenced before the initial investment is undertaken.

There are over 250 pieces of separate State and Federal legislation in Australia, which impose personal financial liability on directors and officers.

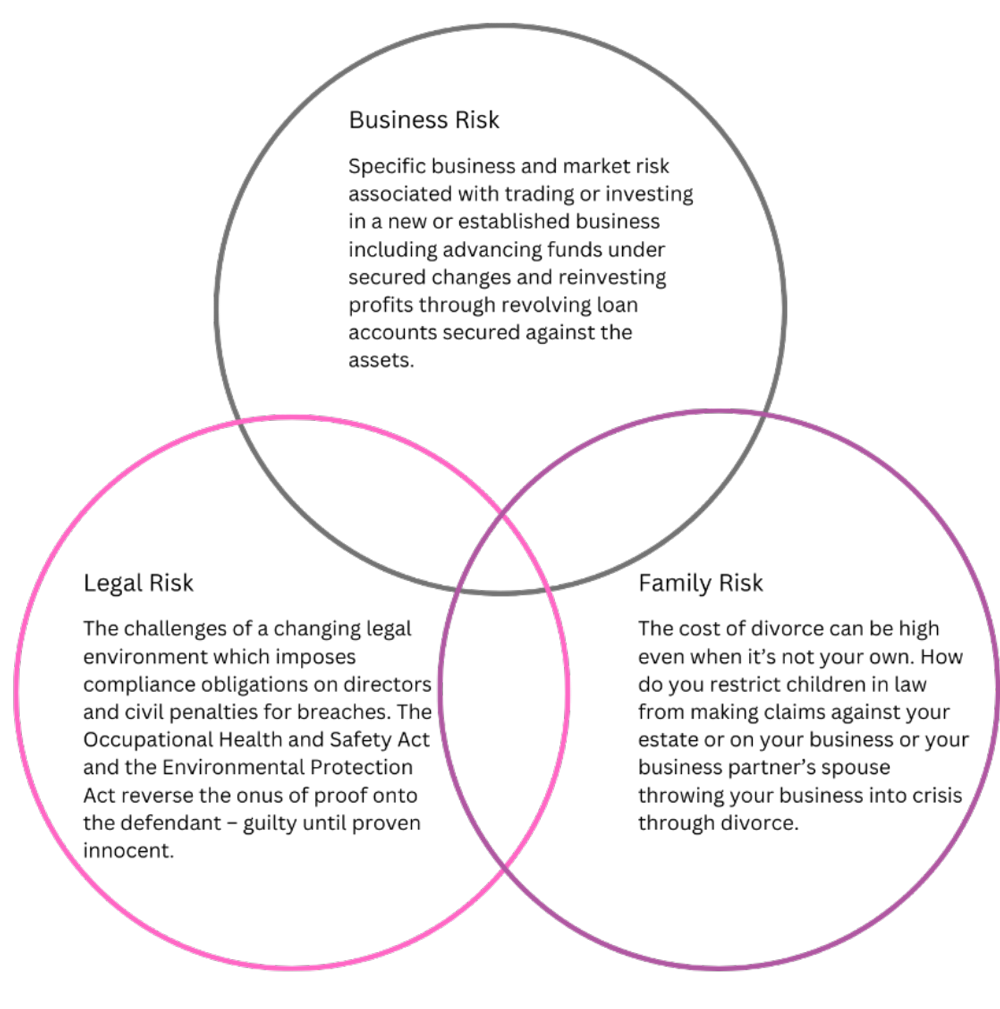

Olvera works with entrepreneurs and business owners to identify the personal risk profile and to understand their risk exposure through our RING asset protection and risk management protocol.

By understanding your risk profile and the exact nature of the risk involved, you can adopt risk management processes that whilst not eliminating risk completely, will help to mitigate your exposure.

The APRM programme recommended should align the control and funding structures to maximise the effectiveness of the corporate structure and minimise the potential value leakage.

How we can help

Our services include:

- Preparing an independent assessment of your corporate and debt structures classified into passive and active asset holdings;

- Determining your personal and business risk profile and appetite statement and allocating your risks into key categories; and

- Recommending and implementing changes to your corporate and personal asset structure to quarantine and mitigate risk.